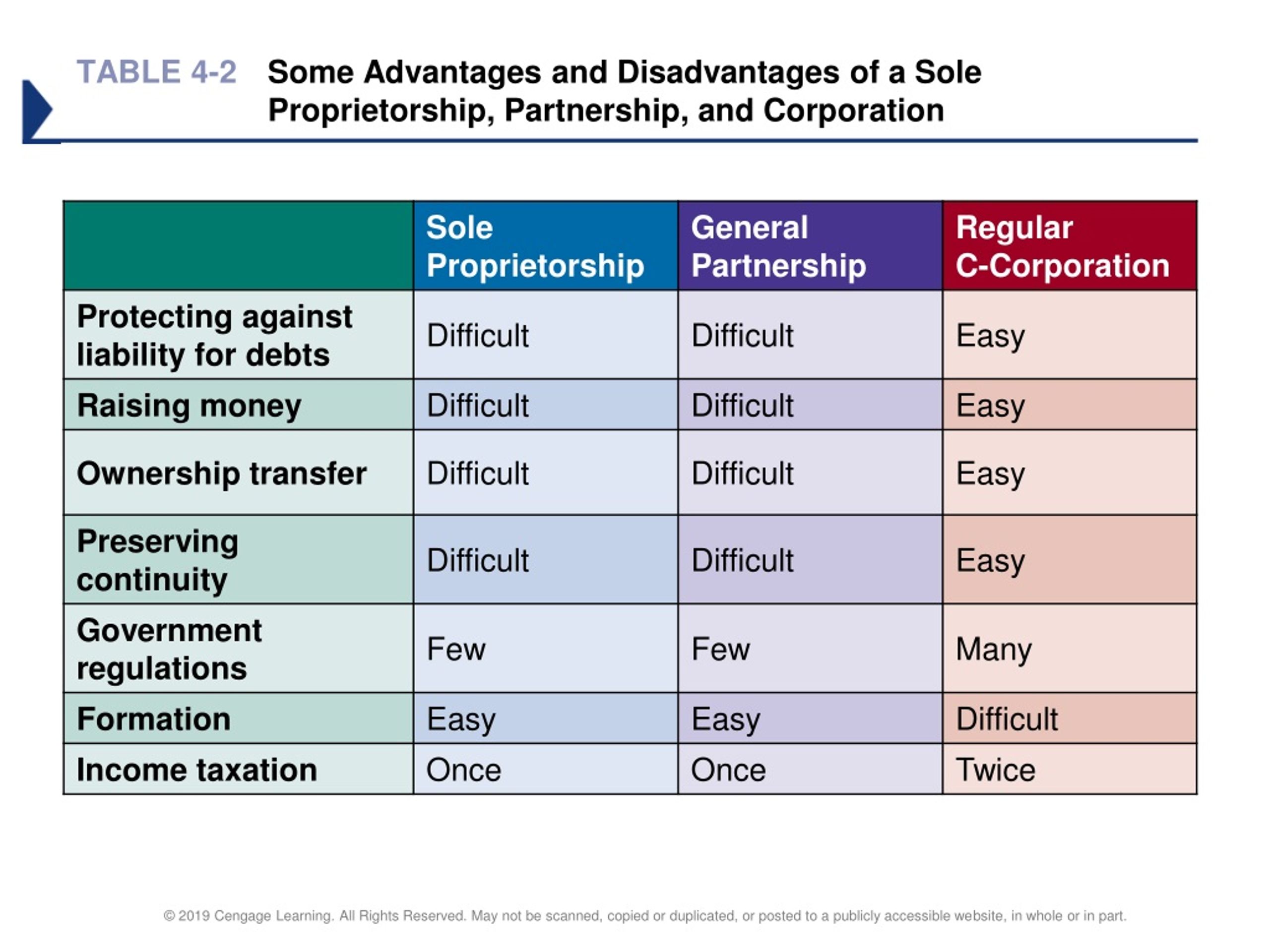

Head to head comparison between Public Company and Private Company Infographics Below are the top 15 differences between Public Company vs Private Company. Pass-Through Businesses.

Ppt Chapter 4 Choosing A Form Of Business Ownership Powerpoint Presentation Id 270630

Can opt for Table A instead of AoA in public limited company by shares.

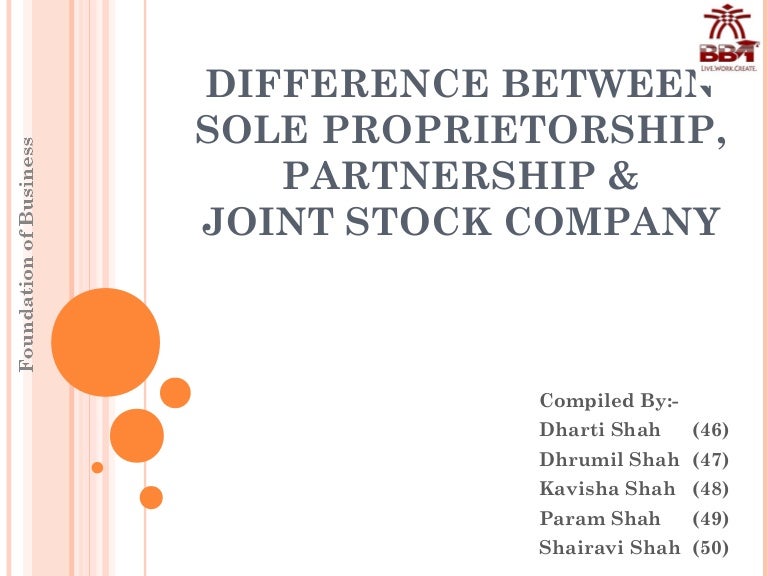

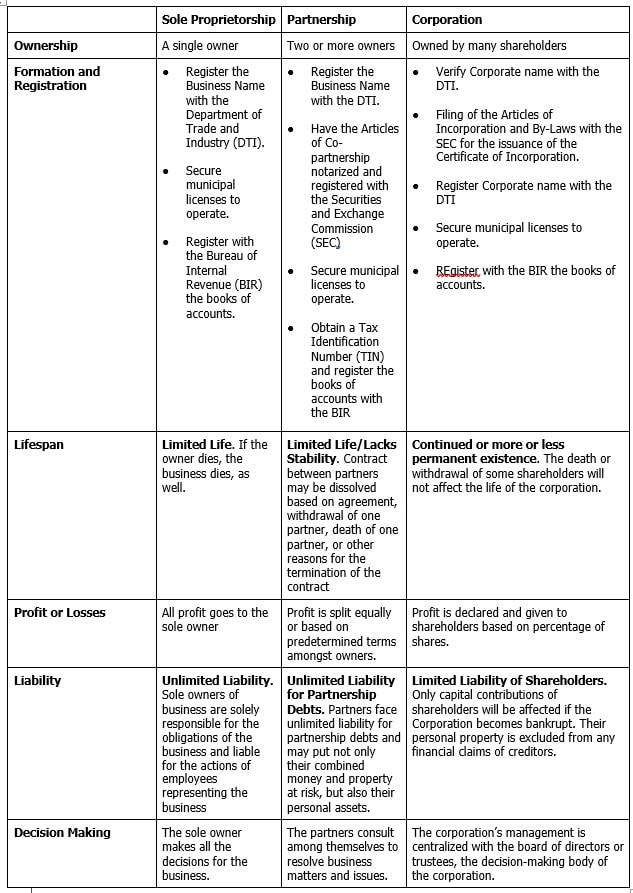

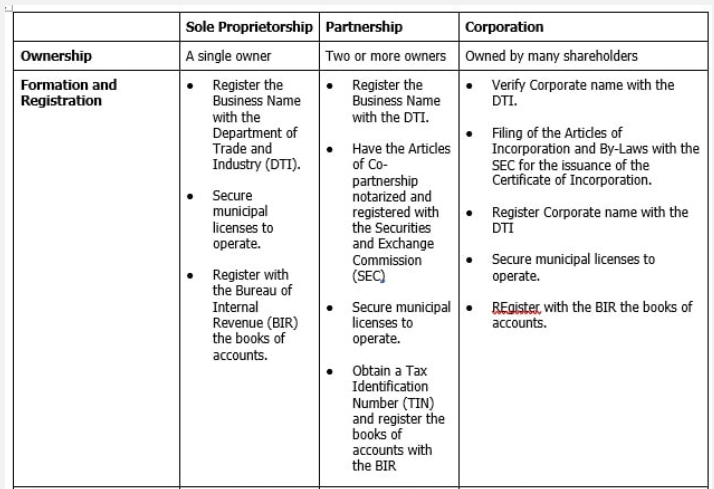

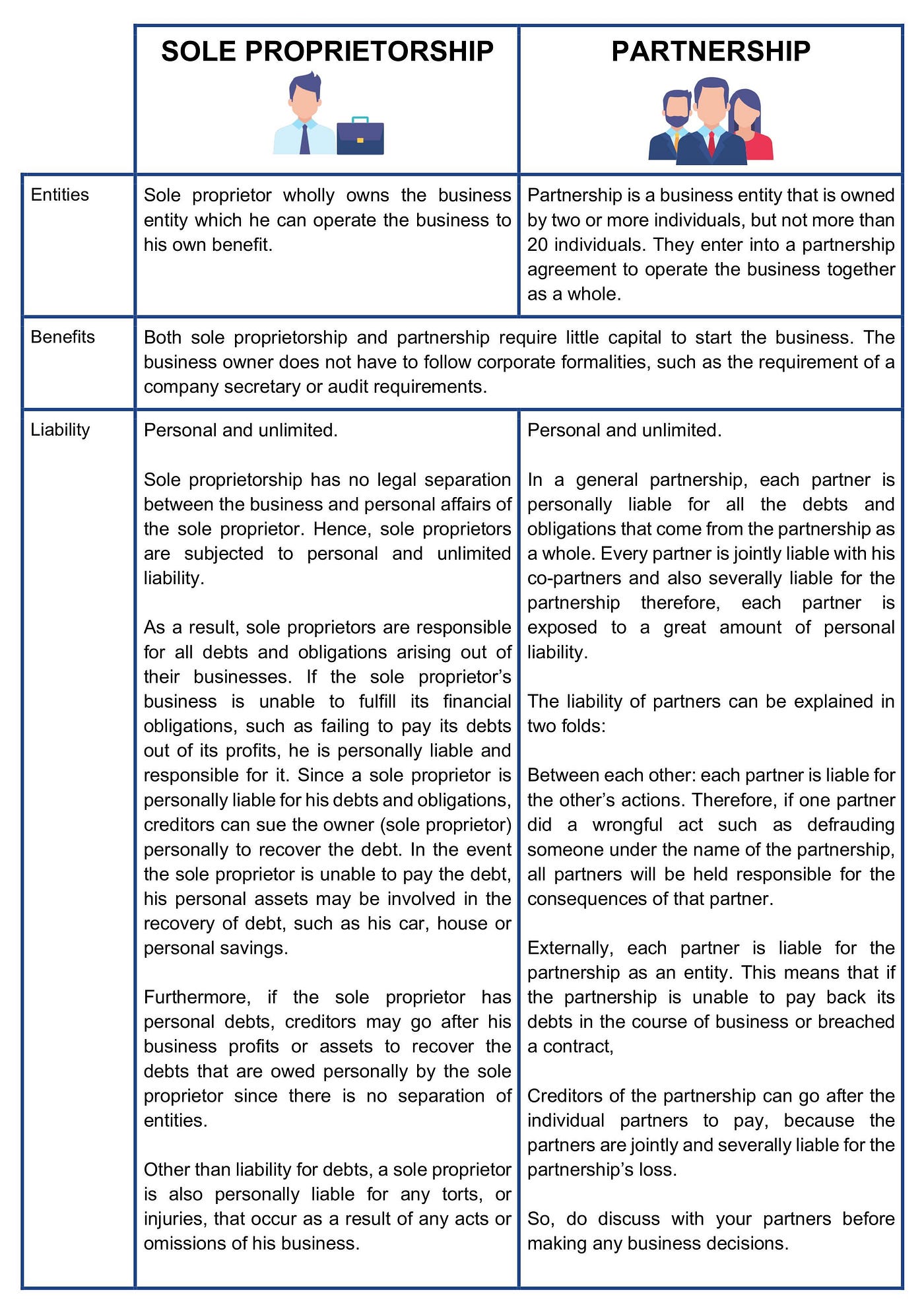

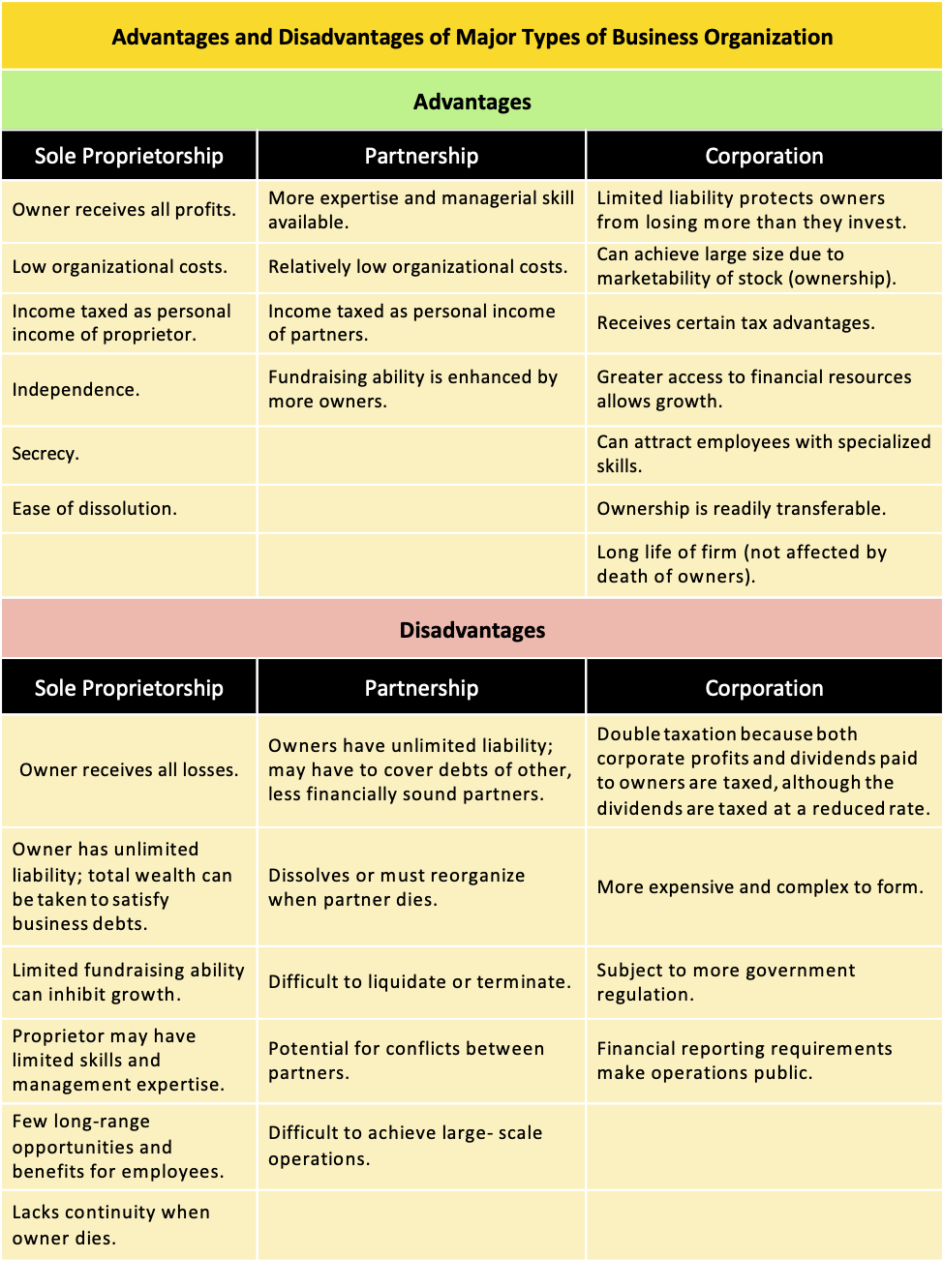

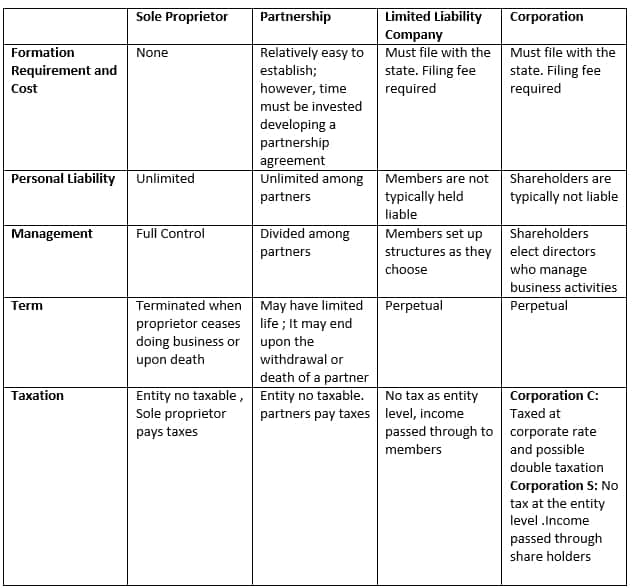

. This type of business organization is formed by the owner himself. Sole proprietorship refers to a business where there is no distinction between the owner and the business entity. An LLC offers a more formal business structure than a sole proprietorship or partnership.

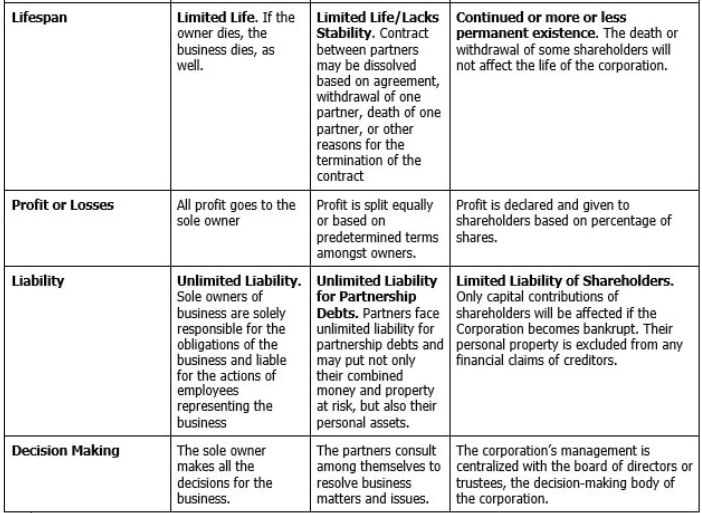

Filing at the time of company registration is optional. The members of the firm are bound by the Partnership Deed and no member can take a sole decision without consulting the other partners. The following table will highlight the most critical points of difference between the types of business entities namely sole proprietorship and partnership.

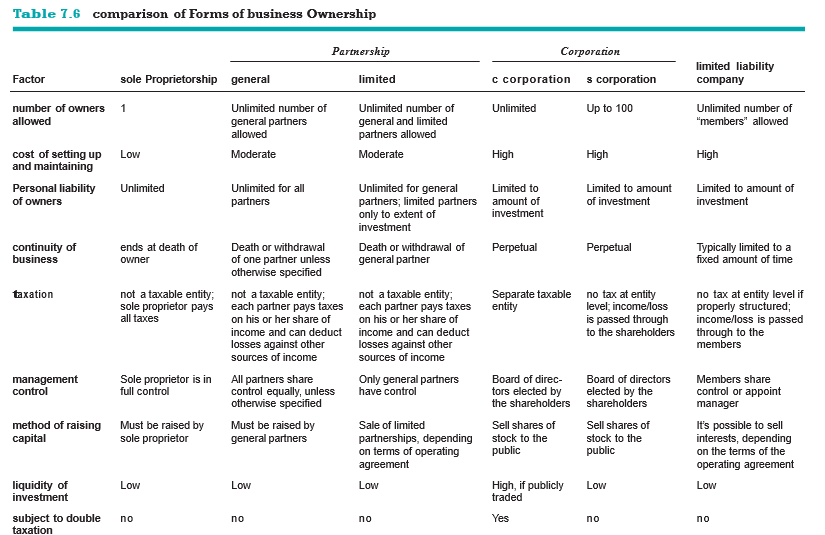

A public company can expand its business by issuing more shares to the general public. Limited liability company LLC A hybrid legal structure that provides the limited liability features of a corporation and the tax efficiencies and operational flexibility of a partnership. General Partnership A general partnership is an association between two or more people in business seeking a profit.

Filing at the time of company registration. A supreme legal document for company and subordinate to Companies Act. For a partnership the owners of the organization are purely responsible for the liabilities of the organization.

The costs to create a sole proprietorship are very low and very little formality is required. Difference Between Sole Proprietorship and Partnership. Head to Head Comparison Between Corporation vs Incorporation Infographics Below is the top 8.

A subordinate to the MoA. It has been filed as part of the Corporate making process and other Particulars such as Company name Proprietary documents the type of Business Future plans etc. A sole proprietorship may be an appropriate form of business for many small and start-up business ventures.

In case of the dissolution of the partnership the properties of the partner members will be taken to pay for the liabilities of the partnership to. A sole proprietor is also known as a sole trader individual entrepreneur and various other names. Another difference between a company and a partnership is the issue of liability.

While LLCs and S corporations two terms are often discussed side-by-side they actually refer to different. Sole proprietorship person fizik A business owned and managed by one individual who is personally liable for all business debts and obligations. A stockholder or a stockholders partnership limited liability company estate trust or corporation if the stockholder and the stockholders partnerships limited liability companies estates trusts and corporations own in the aggregate at least fifty percent 50 of the value of.

For example if a sole proprietor has a net income of 25000 for the year on their Schedule C that amount is added to all the other income of the person and their spouse if they have one along with any. Sole proprietorship firms are considered as individuals owning businesses. Get help navigating a divorce from beginning to end with advice on how to file a guide to the forms you might need and more.

Pass-through businesses are named as such because the tax liability of the business is passed through to the owner as part of the owners personal tax return. A dominant document that helps drafting AoA. A public company needs to disclose its annual report to all the stakeholders.

1 Formation and Closure. No legal conventions are obliged to start the sole proprietorship form of organization. Features of Sole Proprietorship.

Chapter 4 Choosing A Form Of Business Ownership

Difference Between Sole Proprietorship Partnership Joint Stock Com

Difference Between Sole Proprietorship Partnership Joint Stock Com

Learn About Proprietorship Chegg Com

Difference Between Sole Proprietorship Partnership Joint Stock Com

Forming A Partnership Lawyers In The Philippines

Forming A Partnership Lexology

Forming A Partnership Lexology

Want To Be Your Own Boss Here Is How By Legal Street Medium

Choosing A Form Of Business Organization Hkt Consultant

Difference Between Sole Proprietorship And Llc Difference Between

What Are The Benefits And Disadvantages And Taxes Of Operating A Business As A Sole Proprietorship And Private Company Quora

Chapter 4 Forms Of Business Ownership Introduction To Business

Differences Between Sole Proprietorship And Partnerships

Business Entities Ag Decision Maker

Export Import Business Or Trade Name Hkt Consultant

Difference Between A Sole Proprietorship And A Partnership Tutor S Tips

S G Accounting And Secretary Ltd

Choosing The Right Legal Structure For Your Business Considerations For Start Up Businesses